Facts

Restructuring

Care property as a retirement provision

REGROUPING PAYS OFF - SWAP UNPROFITABLE FOR PROFITABLE

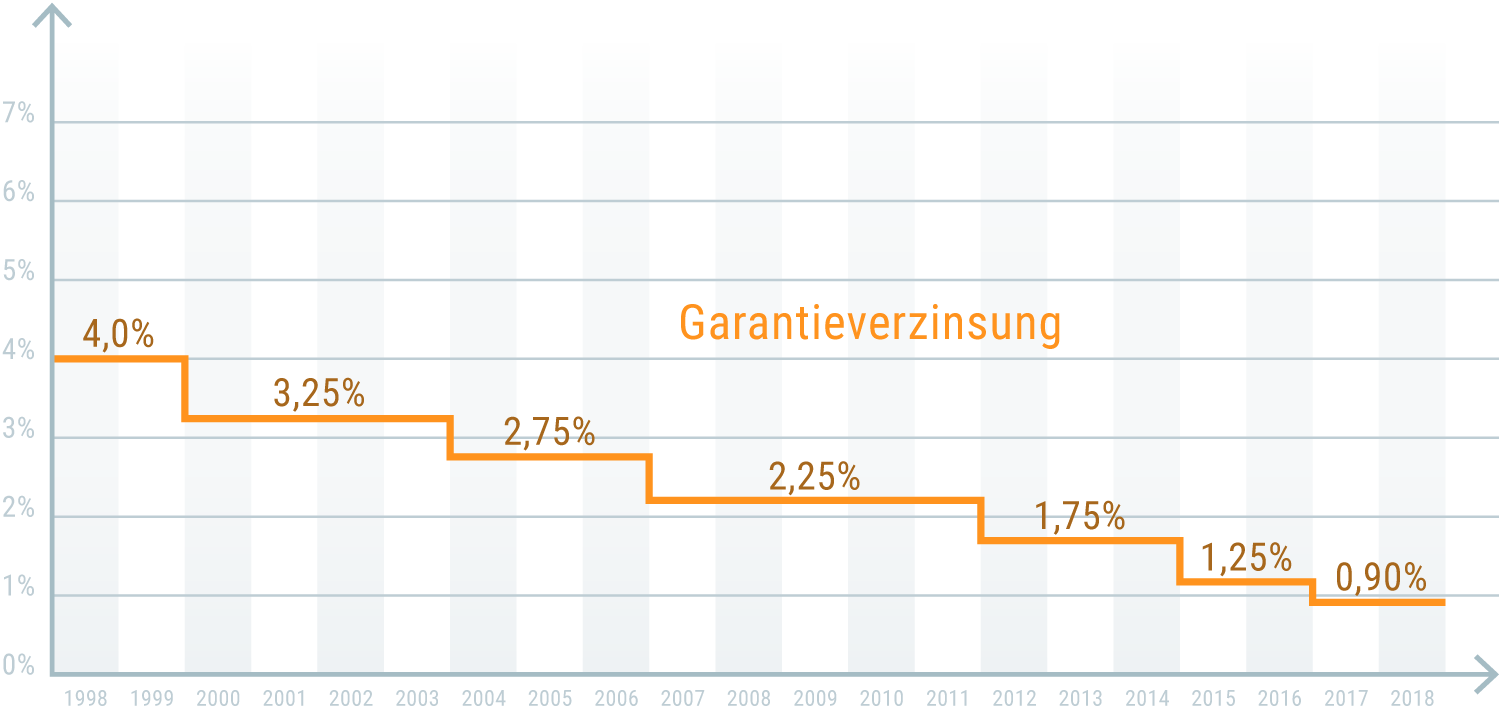

Life and pension insurance policies are nowhere near as profitable as previously predicted. The guaranteed interest rate is historically low. Inflation is doing the rest. The result: at the end of the term, you have gained nothing - on the contrary, the money has lost purchasing power and is therefore worth less. However, once you have taken out the policy, the principle is often: close your eyes and (keep) going. Often for many years.

The situation

Life and pension insurance policies are nowhere near as profitable as previously predicted. The guaranteed interest rate is historically low. Inflation is doing the rest. The result: at the end of the term, you have gained nothing - quite the opposite...

The problem

If you cancel the contracts without having a secure and profitable alternative, this is almost always associated with major losses...

The solution

Unprofitable life and pension insurance policies can be converted into profitable care properties. In this way, you exchange a (less profitable) cash value for a (profitable) tangible asset...