Facts

Tangible assets

REAL ASSETS ARE AHEAD

The conditions for investing and saving have changed massively in Germany in recent years:

Life and pension insurance policies are nowhere near as profitable as previously predicted. The guaranteed interest rate is historically low. Inflation is doing the rest. The result: at the end of the term, you have gained nothing - on the contrary, the money has lost purchasing power and is therefore worth less. However, once you have taken out the policy, the principle is often: close your eyes and (keep) going. Often for many years.

RENDITERESIDENCE - SENSE FACTOR!

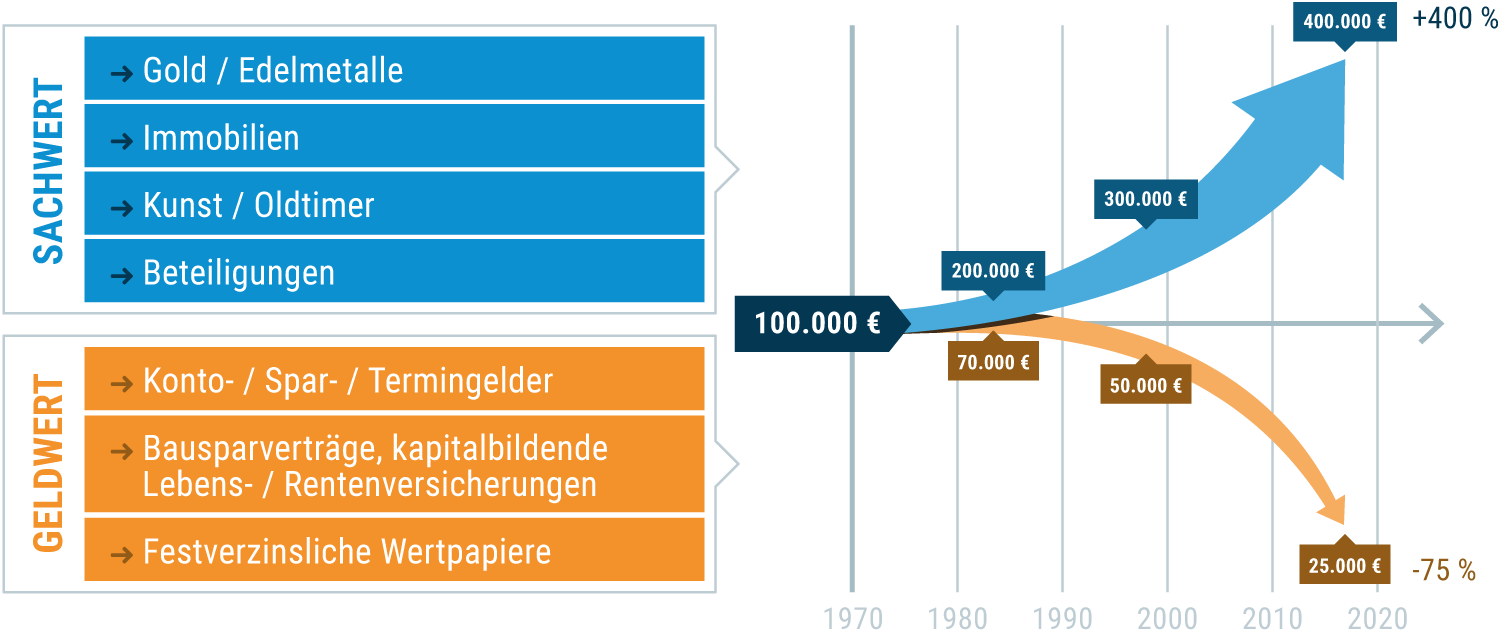

In order to put your own retirement provision on a solid footing, it is crucial to know the difference between cash and non-cash assets. Monetary assets are fragile and lose value easily, whereas tangible assets are stable and often increase in value. Care properties are tangible assets. The most favorable forecasts for the care market of the future make them doubly attractive.

Interest income is approaching zero.

Monetary value products continue to lose value due to inflation. The consequences of this development are that it currently seems impossible to build up solid assets with cash equivalents. The same effect is also evident in all negative events.

Financial market crises and unstable political conditions: Monetary assets are always the first to lose value.

On the other hand, tangible assets such as real estate are more stable because they have a real value. They increase in value over time.

THE TIMING FOR REAL ESTATE INVESTMENTS IS FAVORABLE

Investors have the opportunity to achieve attractive returns

Life and pension insurance policies are nowhere near as profitable as previously predicted. The guaranteed interest rate is historically low. Inflation is doing the rest. The result: at the end of the term, you have gained nothing - on the contrary, the money has lost purchasing power and is therefore worth less. However, once you have taken out the policy, the principle is often: close your eyes and (keep) going. Often for many years.

RENDITERESIDENCE - SENSE FACTOR!

Investing in your own retirement provision is a big step. In addition to the question of which form of investment is suitable, the market itself should also be taken into consideration. Having a good overview of the market helps investors to choose the right product at the right time.