Facts

Investment strategy

SAVE - WITH MONETARY

REGROUPING PAYS OFF - SWAP UNPROFITABLE FOR PROFITABLE

Looking back at the performance of real estate over the past century, it is clear that real estate as a tangible asset retains its value even in times of crisis. This means that they are and remain one of the central building blocks of retirement provision. Current developments make the acquisition of care properties even more interesting: tax advantages and historically low interest rates meet a highly interesting growth market.

The problem

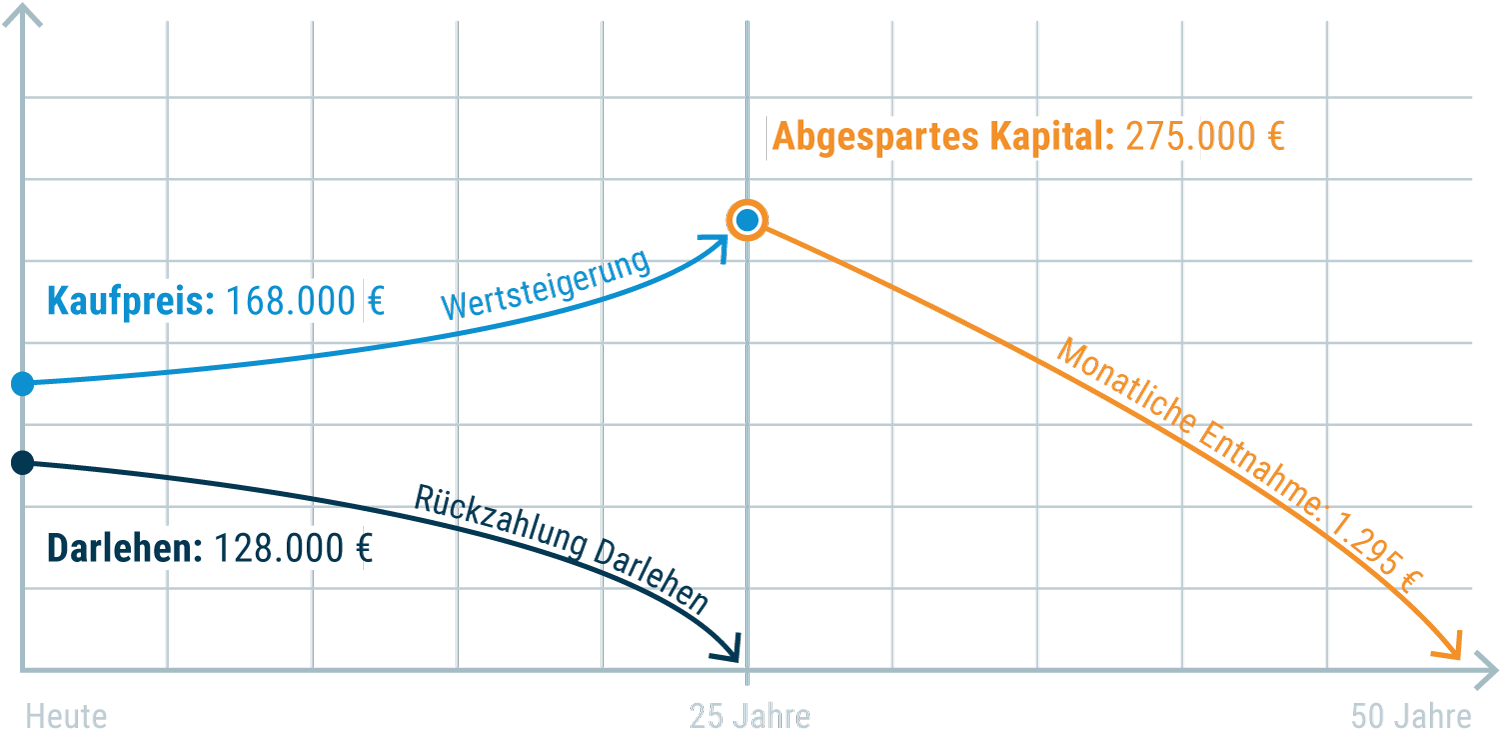

Inflation generally has a negative impact on the savings balance.

The consequence

In most cases, savings are used up during your own retirement, leaving nothing for potential heirs.

SAVE

WITH A CARE PROPERTY

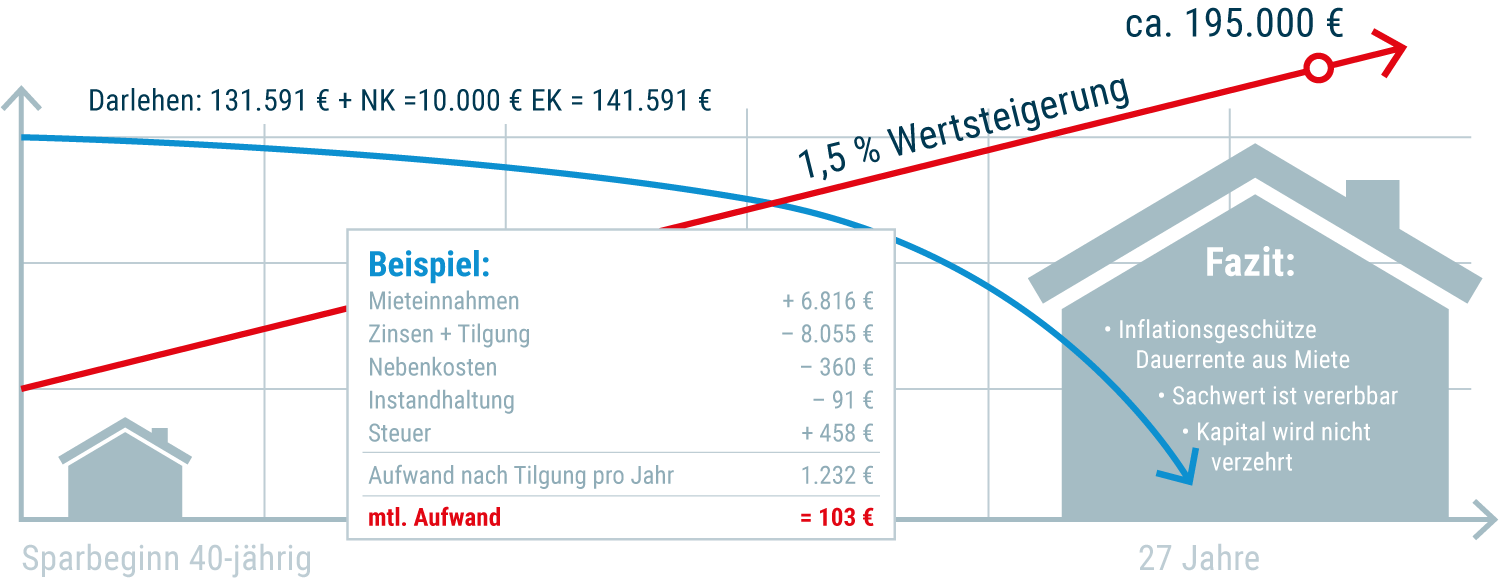

In the case of savings, assets are built up by acquiring a property using a loan financed by borrowing. This is possible with "normal" condominiums or care properties.

A large part of the loan amount is covered by the rental income and tax benefits. The financial outlay is therefore lower than with savings.

Advantages of care properties

Profitable

Safe

Social

Germans are ageing! In the coming years, there will be a massive shift in the ratio of older to younger people in Germany. This means that the need for care places will increase. However, suitable, i.e. age-appropriate living space is already in short supply. The state alone cannot compensate for this. Investing in care properties creates this urgently needed living space and thus also fulfills a social component.

- Guaranteed return of approx. 4% - 5%

- State coverage in accordance with SGB XI

- Rental income for at least 20 - 30 years, even in the event of vacancy or financial difficulties

- Hardly any maintenance costs - only roofing and roofing trades

- No administrative tasks such as letting and ancillary cost accounting

- Attractive financing thanks to low interest rates (interest profit business)

- The location of the property (demand/other care homes in the vicinity, structural conditions of the location)

- The operator: seriousness, size of the company, utilization of other buildings in the portfolio