Facts

Initial situation

Exclusive care properties

Further advantages

It's no secret that Germany is getting older. It is also no secret that this trend will not change in the foreseeable future. However, the question remains as to how this development should be countered. After all, the number of people in need of care will increase. At the same time, the number of people who can provide care at home is steadily decreasing.

Inpatient care properties in accordance with SGB XI are the ideal solution for this development. Residents continue to live independently in a self-contained residential unit, but are connected to professional care by the operator. Investing in care properties is therefore also a social investment, as attractive living space for people in need of care is becoming scarce.

As an investor, you not only benefit from a good feeling, but also from a capital investment that is independent of economic cycles and eligible for subsidies and attractive yields of 3 - 4 %.

Growth market

High demand equals solid returns

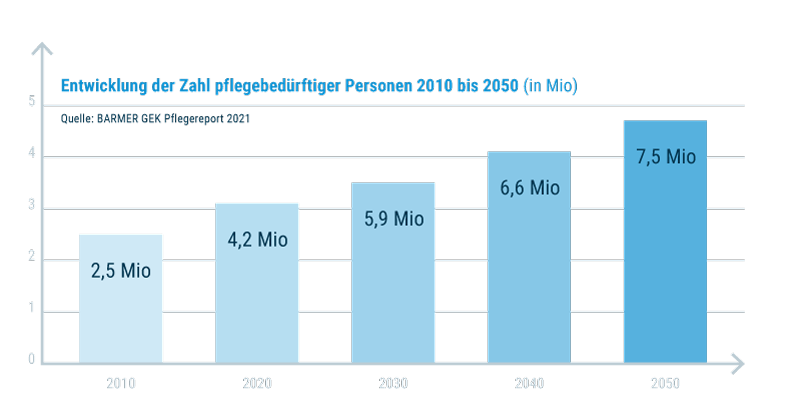

The demand for inpatient care properties is already greater than the supply. And this trend is set to intensify. All studies, calculations and analyses come to the same conclusion: demand will probably have doubled by 2030 - and the available places are already insufficient. The continuing high demand means that care places are becoming increasingly valuable.

For investors, this leads to a comfortable situation: high yields of 3 - 4 % and a solid capital investment in an up-and-coming market. Industry experts believe that yields will even increase in the coming years.

As a future-proof and profitable capital investment, the care property is therefore far ahead of all financial assets, as are other real estate investments.

This chart shows the massive increase in the number of people in need of care in Germany.

Old and young

The relationships are shifting

It has been clear for years that Germany is ageing. But what is actually causing the ratio of young to old in an entire nation to shift - and comparatively quickly? It is a combination of several causes. The main reasons are:

Fewer offspring: the birth rate has remained persistently low for years.higher life expectancy: people are getting older and older as a result of medical advances. Baby boomers are getting old: The baby boomers of the post-war period are reaching retirement age (at the same time, of course).

This requires a response in many areas. The care and housing situation is one of them, as the ageing of the German population is creating a huge demand for care places. Care properties solve part of the problem and therefore also fulfill an important social function. For investors, the future market of care real estate is particularly interesting because it is profitable, secure and social at the same time.